Wonderful time to Buy (or sell your home)!

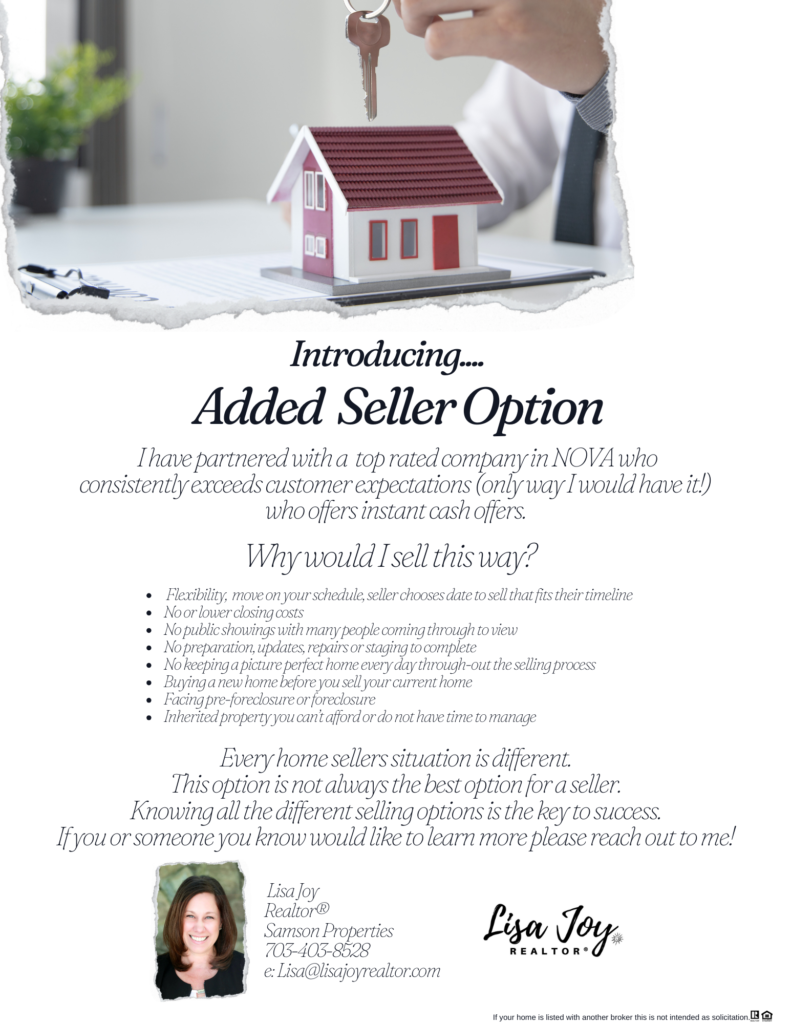

Is It the Most Wonderful Time… to Buy or Sell Your Home? As the holidays approach, the real estate market may not be the first thing on your mind. But contrary to popular belief, this festive season might offer the perfect opportunity for both buyers and sellers. So, is it really a good time to make a move in […]

Wonderful time to Buy (or sell your home)! Read More »